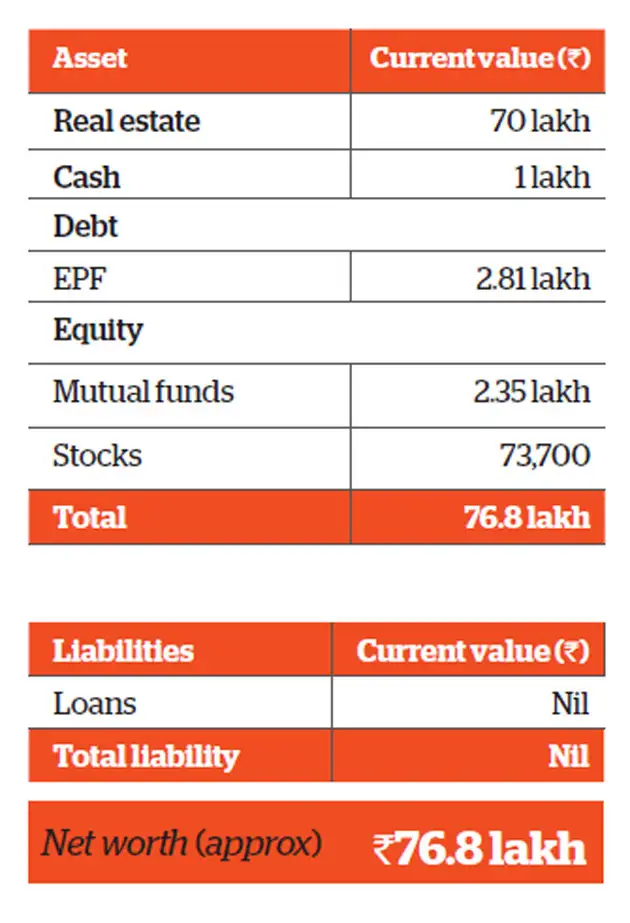

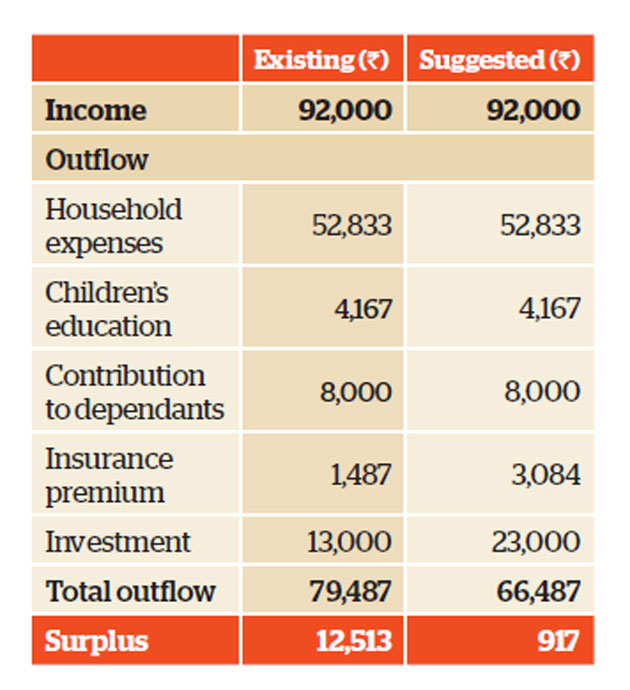

Rahul and Shalini Sapra are both employed in Delhi and bring in a combined monthly income of Rs 92,000. After expenses and investment, they are left with a surplus of Rs 12,513. Having saved aggressively, the couple has already bought a house and has invested in stocks, equity funds and EPF. Their goals include saving for emergencies, future child’s education and wedding, retirement and vacation.

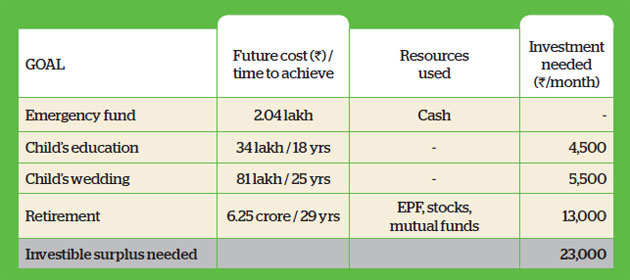

Financial Planner Pankaaj Maalde suggests the couple build an emergency corpus of Rs 2.04 lakh, which is equal to three months’ expenses, by assigning their cash of Rs 1 lakh and saving the surplus for a year. This amount should be invested in an ultra short-term fund and should be increased to six months’ worth of expenses at the earliest.

Portfolio

Next, the couple wants to save Rs 34 lakh for their future child’s education in 18 years. To reach the goal, they will need to start an SIP of Rs 4,500 in an equity fund. Similarly, for the goal of the child’s wedding in 25 years, they will have to start an SIP of Rs 5,500 in an equity fund and gold bonds. However, they will have to start investing after a year when they have built the emergency corpus.

Cashflow

The Sapras want to plan their retirement in 29 years and save Rs 6.25 crore for this goal. To achieve this, they will have to assign their EPF corpus, stocks and equity funds. Besides these, they will need to start an SIP of Rs 13,000 in a diversified equity fund. As for the goal of vacation worth Rs 8.5 lakh in five years, the couple will need to start an SIP of Rs 6,000 in a balanced fund. However, due to lack of surplus, they will have to put off the goal till a further rise in income.

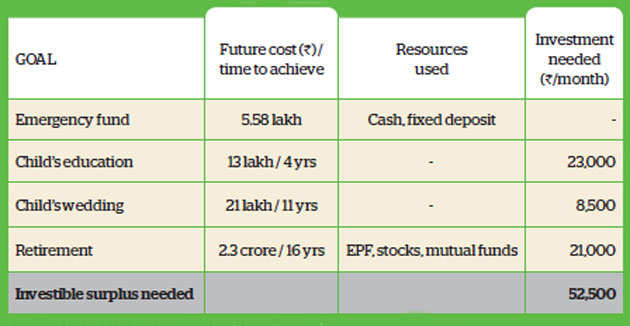

How to invest for goals

Annual return assumed to be 12% for equity. Inflation assumed to be 7%.

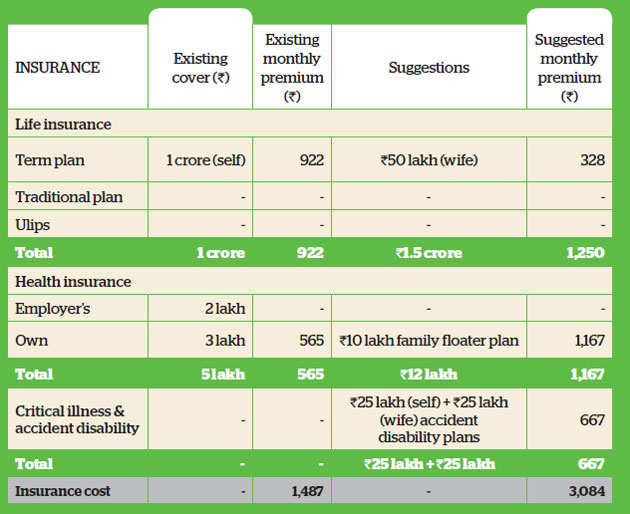

The couple has done well when it comes to insurance. For life insurance, Rahul has a Rs 1 crore term plan, but Shalini doesn’t have any cover. Maalde suggests she pick a Rs 50 lakh online term plan for 30 years. For health, the couple has a Rs 2 lakh cover provided by the employer and a Rs 3 lakh independent plan. Maalde suggests they increase this cover to Rs 10 lakh at the next renewal. Both of them should also pick Rs 25 lakh accident disability plans at the earliest.

Insurance portfolio

Premiums are indicative and could vary for different insurers.

Financial plan by Pankaaj Maalde Certified Financial Planner

Write to us for expert advice

Looking for a professional to analyse your investment portfolio? Write to us at [email protected] with ‘Family Finances’ as the subject. Our experts will study your portfolio and offer objective advice on where and how much you need to invest to reach your goals.

[“Source-economictimes”]