Greece’s outspoken finance minister has resigned, hours after voters backed his call to reject creditors’ demands for more austerity in a referendum.

Yanis Varoufakis said it was felt his departure would be helpful in finding a solution to the country’s debt crisis.

Eurozone finance ministers, with whom he repeatedly clashed, had wanted him removed, Mr Varoufakis explained.

Meanwhile, global financial markets have fallenover fears that Greece is heading for an exit from the euro.

The European Central Bank (ECB) is to discuss whether to raise its emergency cash support for Greek banks, which are running out of funds and on the verge of collapse.

Greece’s Economy Minister, Georgios Stathakis, told the BBC the ECB had to keep Greek banks alive for seven to 10 days so that negotiations could take place.

But even if the ECB continued to freeze the Emergency Liquidity Assistance (ELA) at €89bn (£63bn; $98bn), the current cash withdrawal and transfer restrictions on banks of €60 per day could stay in place until Friday, without any of them collapsing, he said.

Follow the latest updates

BBC Europe editor Katya Adler says the 19-nation eurozone’s most powerful members, France and Germany are at odds over what to do next, with France taking a softer and Germany a harder line.

German Chancellor Angela Merkel will meet French President Francois Hollande in Paris later on Monday, and there will be a summit of eurozone leaders on Tuesday.

The majority of Greeks say they want to stay in the single currency, but their angry “No” vote in Sunday’s referendum has made that far harder, our correspondent adds.

‘Creditors’ loathing’

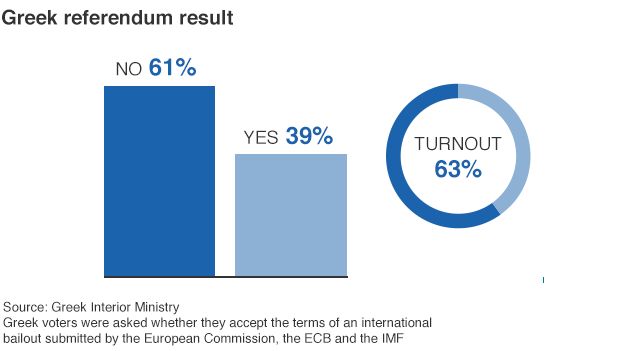

Mr Varoufakis announced his resignation on his blog only hours after it emerged that 61.3% of the 6.16 million Greeks who voted had rejected the demands for more austerity from the ECB, the European Commission and the International Monetary Fund (IMF).

He said Sunday’s referendum would “stay in history as a unique moment when a small European nation rose up against debt-bondage”.

By Mark Lowen, BBC News, Athens

He went with a typical rhetorical flourish: “I shall wear the creditors’ loathing with pride,” wrote Yanis Varoufakis, known as much for his leather jackets as his flamboyant language – “austerity is like trying to extract milk from a sick cow by whipping it”, being just one of his gems. But Greece’s outgoing finance minister was an obstacle to an urgent deal with Brussels. Adored by his supporters back home, he was hated by eurozone leaders, whom he accused of “terrorism” towards Greece.

His departure – or removal – is a clear gesture by Prime Minister Alexis Tsipras that he wants fresh debt talks and a deal as soon as possible. He certainly needs one: Greek banks are so critically low on funds that they could collapse in days without an injection of cash from the European Central Bank. But it will only lend if Greek banks are solvent – which they’re not – or Greece is in a bailout scheme – which it isn’t. So the door to a eurozone exit inches ever closer.

Greece achieved a political earthquake last night. But the aftershocks could be far greater.

Mr Varoufakis added that he had been “made aware of a certain preference by some Eurogroup participants, and assorted ‘partners’, for my… ‘absence’ from its meetings”.

Prime Minister Tsipras had judged this to be “potentially helpful to him in reaching an agreement”, he noted.

Belgian Finance Minister Johan Van Overtveldt told VRT radio: “To say that it wasn’t nice to hear him more or less saying that his fellow ministers were terrorists is of course an understatement.”

As thousands of Greeks took to the streets celebrate the referendum result on Sunday evening, Mr Tsipras said they had “made a very brave choice”.

“The mandate you gave me is not the mandate of a rupture with Europe, but a mandate to strengthen our negotiating position to seek a viable solution,” he added.

He said that he was willing to go back to the negotiating table on Monday, noting that an International Monetary Fund (IMF) assessment published this week confirmed that restructuring Greece’s debt of more than €300bn (£213bn; $331bn) was necessary.

The BBC’s Chris Morris in Athens says there is huge scepticism in other capitals and this is a big gamble.

Without some sign that an agreement on longer-term funding is still possible, the ECB could soon be forced to pull the plug, he adds.

Eurozone finance ministers said they expected to hear “new proposals from the Greek authorities” when they meet in Brussels on Tuesday.

“The basis of a dialogue is on the table, but it’s up to Greece to show us that it takes the dialogue seriously,” French Finance Minister Michel Sapin told Europe 1 radio.

German government spokesman Steffen Seibert said “conditions to start negotiations on a new aid programme are not met yet”.

More European reaction:

- Dutch Finance Minister Jeroen Dijsselbloem, who heads the Eurogroup, said the referendum result “doesn’t bring us closer to a solution right away”

- European Parliament President Martin Schulz called on Greece’s government to make “meaningful and constructive proposals”

- EU foreign policy chief Federica Mogherini tweeted that the vote meant “painful days for all those that believe in a united Europe”

- Italian Prime Minister Matteo Renzi said the eurozone meetings on Tuesday had to “show a definitive way to resolve this emergency”

The European Commission’s vice-president for the euro, Valdis Dombrovskis, said the stability of the eurozone was “not in question”. But he also stated that the commission had not been given a mandate by member states to negotiate.

In a telephone conversation with Mr Tsipras, Russian President Vladimir Putin expressed support for the people of Greece “as they overcome difficulties”, Russian media reported.

Greece had been locked in negotiations with its creditors for months when the Greek government unexpectedly called a referendum on the terms it was being offered.

Greece’s last bailout expired on Tuesday and Greece missed a €1.6bn (£1.1bn) payment to the IMF.

The European Commission – one of the “troika” of creditors along with the IMF and the ECB – wanted Athens to raise taxes and slash welfare spending to meet its debt obligations.

Greece’s Syriza-led government, which was elected in January on an anti-austerity platform, said creditors had tried to use fear to put pressure on Greeks.

[“source – bbc.com”]