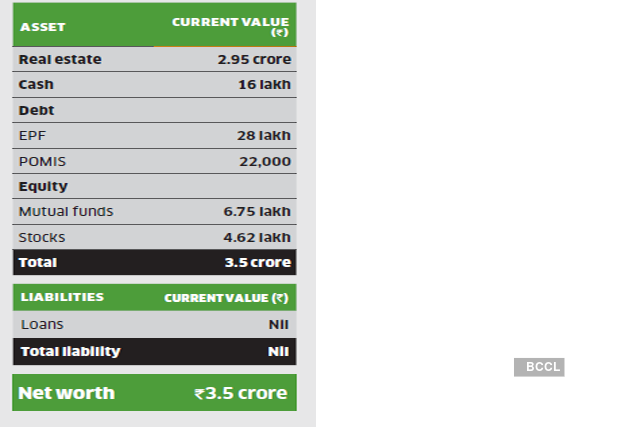

Chirag Shukla, 38, stays with his wife, 36, two children, aged 10 and 7, and his mother, in Mumbai. While his wife earns Rs 15,000 a month, he also gets a monthly rental income of Rs 38,000. He has property worth Rs 2.9 crore, which includes a self-occupied house worth Rs 1.6 crore. He has no loans and his net worth is Rs 3.5 crore. This includes cash of Rs 16 lakh, debt including Rs 28 lakh of EPF and Rs 22,000 in a post office scheme, and equity worth Rs 11.3 lakh in the form of stocks and mutual funds.

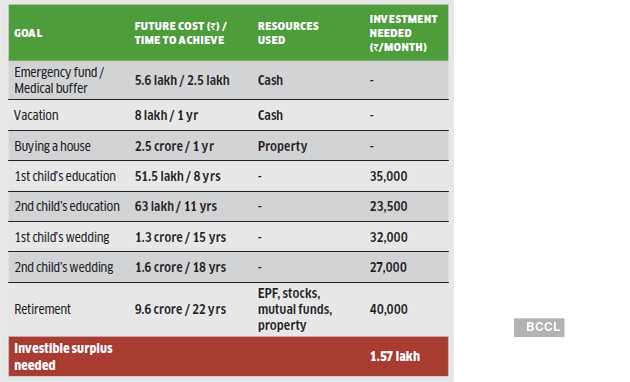

His goals include building an emergency corpus and a medical buffer for his mother, taking a vacation, buying a bigger house, saving for his children’s education and weddings, and for his retirement.

Portfolio

Financial Planner Pankaaj Maalde suggests that Shukla begin by building a contingency corpus of Rs 5.6 lakh, equal to six months’ expenses, and Rs 2.5 lakh of medical buffer. He can allocate a portion of his cash and invest it in a liquid fund. Next, Shukla wants to buy a house worth Rs 2.5 crore in a year’s time. He can sell two of his existing properties to meet this goal. To fund an Rs 8 lakh vacation in a year’s time, he can use the remaining cash.

Cash flow

To fund his children’s education in eight and 11 years, he will need Rs 51.5 lakh and Rs 63 lakh, respectively. For these goals, he can start SIPs of Rs 35,000 in a hybrid equity fund and Rs 23,500 in a diversified equity fund. For the kids’ weddings in 15 and 18 years, Shukla will need Rs 1.3 crore and Rs 1.6 crore, respectively.

How to invest for goals

Annual return assumed to be 12% for equity, 8% for debt funds. Inflation assumed to be 7%.

For the former, he can start an SIP of Rs 29,000 in a diversified equity fund and Rs 3,000 in the gold bond scheme, while for the latter, he can start an SIP of Rs 24,000 in a diversified equity fund and Rs 3,000 in the gold bond scheme. For retirement, Shukla will need Rs 9.6 crore in 22 years. He can assign his stocks, mutual funds, EPF and property, besides starting an SIP of Rs 40,000 in a diversified equity fund to meet the goal.

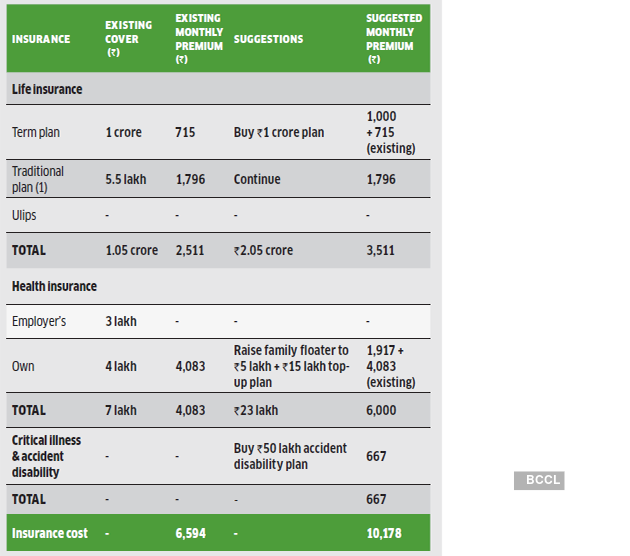

Insurance portfolio

Premiums are indicative and could vary for different insurers.

For life insurance, Shukla has one traditional plan and one term plan of Rs 1 crore. Maalde suggests he continue with the former and buy another term plan of Rs 1 crore for Rs 1,000 a month. For health insurance, Shukla has a Rs 4 lakh family floater plan, besides a Rs 3 lakh plan provided by his company. Maalde suggests he upgrade to a Rs 5 lakh plan and buy a Rs 15 lakh top-up plan with a Rs 5 lakh deductible. This will cost him Rs 1,917 a month. He should also buy a Rs 50 lakh accident disability plan for Rs 667 a month.

[“source=economictimes”]